AWS took a hard blow last year when it lost the $10 billion, decade-long JEDI cloud contract to rival Microsoft. Yet even without that mega deal for building out the nation’s Joint Enterprise Defense Infrastructure, the company remains fully in control of the cloud infrastructure market — and it intends to fight that decision.

In fact, AWS still owns almost twice as much cloud infrastructure market share as Microsoft, its closest rival. While the two will battle over the next decade for big contracts like JEDI, for now, AWS doesn’t have much to worry about.

There was a lot more to AWS’s year than simply losing JEDI. Per usual, the news came out with a flurry of announcements and enhancements to its vast product set. Among the more interesting moves was a shift to the edge, the fact the company is getting more serious about the chip business and a big dose of machine learning product announcements.

The fact is that AWS has such market momentum now, it’s a legitimate question to ask if anyone, even Microsoft, can catch up. The market is continuing to expand though, and the next battle is for that remaining market share. AWS CEO Andy Jassy spent more time than in the past trashing Microsoft at 2019’s re:Invent customer conference in December, imploring customers to move to the cloud faster and showing that his company is preparing for a battle with its rivals in the years ahead.

AWS remains in firm control of the cloud infrastructure market

Numbers, please

AWS closed 2019 on a $36 billion run rate, growing from $7.43 billion in in its first report in January to $9 billion in earnings for its most recent earnings report in October. Believe it or not, according to CNBC, that number failed to meet analysts expectations of $9.1 billion, but still accounted for 13% of Amazon’s revenue in the quarter.

Regardless, AWS is a juggernaut, which is fairly amazing when you consider that it started as a side project for Amazon.com in 2006. In fact, if AWS were a stand-alone company, it would be a substantial business. While growth slowed a bit last year, that’s inevitable when you get as large as AWS, says John Dinsdale, VP, chief analyst and general manager at Synergy Research, a firm that follows all aspects of the cloud market.

“This is just math and the law of large numbers. On average over the last four quarters, it has incremented its revenues by well over $500 million per quarter. So it has grown its quarterly revenues by well over $2 billion in a twelve-month period,” he said.

Dinsdale added, “To put that into context, this growth in quarterly revenue is bigger than Google’s total revenues in cloud infrastructure services. In a very large market that is growing at over 35% per year, AWS market share is holding steady.”

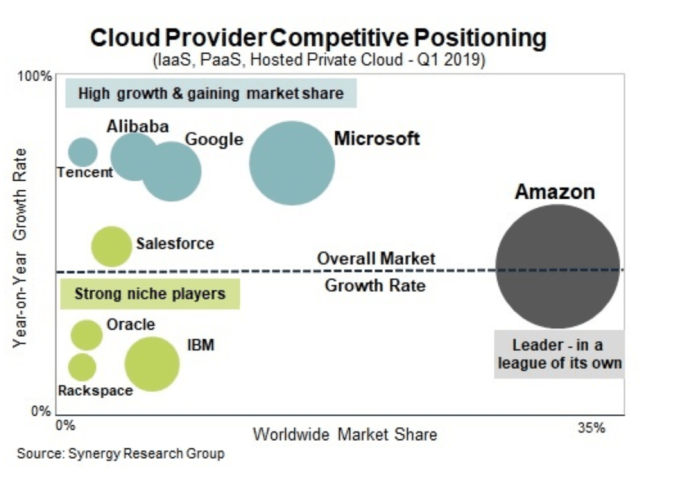

Dinsdale says the cloud infrastructure market didn’t quite break $100 billion last year, but even without full Q4 results, his firm’s models project a total of around $95 billion, up 37% over 2018. AWS has more than a third of that. Microsoft is way back at around 17% with Google in third with around 8 or 9%.

JEDI disappointment

It would be hard to do any year-end review of AWS without discussing JEDI. From the moment the Department of Defense announced its decade-long, $10 billion cloud RFP, it has been one big controversy after another.

From the earliest days, Oracle in particular, complained to anyone who would listen, including the president, that the project’s parameters had been skewed for AWS to win the contract. The DoD issued repeated denials, but the president’s own actions didn’t help as he reportedly wanted to keep Jeff Bezos’ company from getting the contract.

Why the Pentagon’s $10 billion JEDI deal has cloud companies going nuts

There were lawsuits, official complaints, unofficial complaints and internal DoD reviews aplenty, but the drama peaked on Friday, October 25th when the DoD made its pronouncement that it was Microsoft and not AWS that had won the contract.

Oracle had to be embarrassed at the result after exerting so much effort to show AWS was the favorite, but AWS was truly shocked it lost, telling TechCrunch’s Frederic Lardinois:

“We’re surprised about this conclusion. AWS is the clear leader in cloud computing, and a detailed assessment purely on the comparative offerings clearly lead to a different conclusion.”

It didn’t take long for Amazon to push back. In November, the company indicated it would file a lawsuit, and earlier this month it followed through. At an AWS re:Invent press event earlier this month, Jassy made it clear he thought the decision was flawed. “I would say is that it’s fairly obvious that we feel pretty strongly that it was not adjudicated fairly,” he said.

He added, “I think that we ended up with a situation where there was political interference. When you have a sitting president, who has shared openly his disdain for a company, and the leader of that company, it makes it really difficult for government agencies, including the DoD, to make objective decisions without fear of reprisal.”

That case remains ongoing and will likely be settled some time in 2020.

New products aplenty

It would be wrong, however, to suggest that AWS’s year was defined by losing the JEDI contract. As its financials show, it continues to grow and remains in firm control of the cloud infrastructure market. While it didn’t roll out new products at quite the same pace it has in the past, it certainly introduced or updated a fair number.

Machine learning was top of mind for AWS this year, and at re:Invent the company introduced a number of products designed to help customers build and deploy machine learning models. To that end, it announced SageMaker Studios, a development environment of sorts for building machine learning models. It included a bunch of pieces including notebooks and monitoring to give customers a complete AWS machine learning solution on top of SageMaker. With SageMaker, customers can deploy and manage those models.

It also introduced a new smart keyboard called DeepComposer that it hoped would encourage developers to get involved with machine learning in a fun way, much like it did with earlier tools like the DeepLens camera introduced in 2017 and the DeepRacer car it added last year.

The company moved computing closer to the edge, introducing first Local Zone in Los Angeles and making its on-prem hardware product Outposts, introduced last year, generally available.

It also began delving into quantum computing with the introduction of a Quantum service called Bracket and it pushed deeper into chips with Graviton 2 processors and custom Inferentia chips. It might not have been the same number of announcements as in the past, but the company certainly showed that it’s still an industry leader.

Road ahead

That Jassy took some jabs at Microsoft in his re:Invent keynote (and later in the week at a press conference) shows that Amazon considers Microsoft as legitimate competition, as it should. Jassy has expressed in the past that there was room for more than one winner in this market and AWS’ current market share numbers back that up. But Jassy sees a rival that is still a couple of technology steps behind, and while he has clearly begun to worry about it, he is quick to point out that his company has a head start.

Answering a question about the JEDI contract, he pointed out that “most of our customers tell us we are a couple of years ahead [of Microsoft] both in terms of functionality and maturity.”

Jassy was less patient with the pace of change inside large organizations this year, pushing audience members to move to the cloud faster. While there are no exact numbers in terms of the percentage of workloads currently in the cloud, a substantial percentage are still on-prem. As David Linthicum, managing director and chief cloud strategy officer at Deloitte said, migration problems lie deep within the enterprise and it will be difficult to force march large organizations to the cloud. That means it’s going to be hard to move faster, no matter how badly Jassy may want it.

“All cloud providers look out for their own best interest. We are in a land grab situation. Getting people on their cloud [involves] fairly sticky transactions. Jassy [and the other cloud vendors] are trying to get customers to their cloud as quickly as they can,” he said.

This all matters because as Linthicum pointed out, once you get a cloud customer, you tend to keep them because moving around is hard. That could explain why Jassy was pushing for change to happen faster, and of course for those customers to choose AWS.

Jassy told SiliconAngle’s John Furrier that he believes that customers will use multiple vendors, but there will be a primary one, where the majority of the business goes:

“[T]he “vast majority” of organizations pursuing a multicloud strategy tend to pick a predominant provider and then, if they feel like they want another one, either because there’s a group that really is passionate about them or they want to know they can use a second cloud provider in case they fall out of sorts with the initial cloud provider, they will. Jassy went on to say that for customers implementing multiple clouds the workloads are split between a primary and secondary cloud more like 70/30 or 80/20 or 90/10, not 50/50.”

As Linthicum points out, the easy workloads have been moved; now comes the much more difficult parts which will take more time, patience and tooling. That untapped market — and helping enterprise customers move those workloads — is still up for grabs. That is why the road ahead has so much promise, and conversely, so much peril, depending on which way customers go.

AWS wants it all and seems to feel the competition pushing from behind. As usual, the company doesn’t intend to cede anything to the competition.

AWS is sick of waiting for your company to move to the cloud

Comment